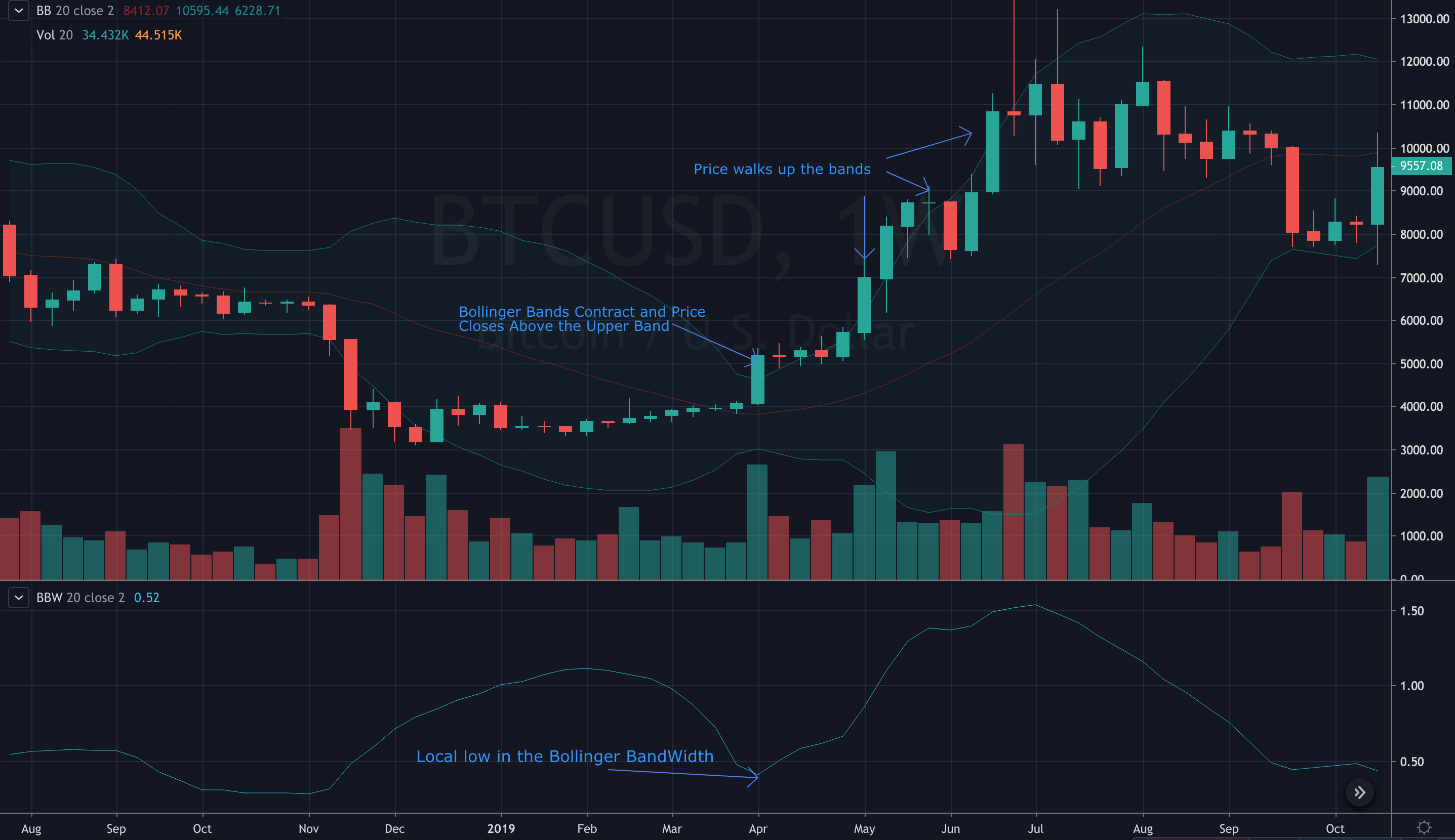

Bollinger Bands Cryptocurrency | The term 'bollinger bands' was originally coined by bollinger himself during a live broadcast. Bollinger bands were invented by john bollinger and a re a staple technical analysts tool when charting the markets. Bollinger bands explained appeared first on coin rivet. Bollinger bands provide an upper bound and lower bound based on a simple. A common strategy adopted by traders is to go. Bollinger bands are technical indicators developed by john bollinger and widely used by stock traders today. The bollinger bands service provides charts, screening and analysis based on bollinger bands. Bollinger bands (bb) are a widely popular technical analysis instrument created by john bollinger bollinger bands with color indicators to detect two key scenarios : Bollinger bands, a technical indicator developed by john bollinger, are used to measure a market's volatility the bollinger bands (bb) is a chart overlay indicator meaning it's displayed over the price. Bollinger bands are envelopes plotted at a standard deviation level above and. In the notoriously fickle cryptocurrency market, bollinger bands are seeing widespread use in predicting possible breakouts. A bollinger band® is a momentum indicator used in technical analysis that depicts two standard bollinger bands® were developed and copyrighted by famous technical trader john bollinger. The bollinger bands service provides charts, screening and analysis based on bollinger bands. Bollinger bands are named after john bollinger, an american asset manager, and technical analyst. Bollinger bands (/ˈbɒlɪnjdʒər bændz/) are a type of statistical chart characterizing the prices and volatility over time of a financial instrument or commodity, using a formulaic method propounded by john bollinger in the 1980s. Bollinger bands (bb) were created in the early 1980s by financial analyst and trader john. Investors also use bollinger bands to help determine buy and sell signals on a stock. Using bollinger band with trade strategies for newer cryptocurrency traders, learning how to successfully time market entries and exits is a fundamental challenge. How are bollinger bands calculated? The bollinger bands indicator is an oscillator with respect to trade cryptos or while talking about analysis. The term 'bollinger bands' was originally coined by bollinger himself during a live broadcast. Bollinger bands were invented by john bollinger and a re a staple technical analysts tool when charting the markets. The the post trading cryptocurrency: Bollinger bands are envelopes plotted at a standard deviation level above and. Bollinger bands® are a popular technical analysis tool that indicates whether an instrument's price is bollinger bands consist of three lines on a trader's chart. A common strategy adopted by traders is to go. The middle line of the indicator is the. Bollinger bands are named after john bollinger, an american asset manager, and technical analyst. Bollinger bands (bb) were created in the early 1980s by financial analyst and trader john. Essentially bollinger bands® are a way to measure and visualize volatility. Bollinger bands explained appeared first on coin rivet. Bollinger bands (bb) are a widely popular technical analysis instrument created by john bollinger bollinger bands with color indicators to detect two key scenarios : Bollinger bands are a type of price envelope developed by john bollinger. Bollinger bands (/ˈbɒlɪnjdʒər bændz/) are a type of statistical chart characterizing the prices and volatility over time of a financial instrument or commodity, using a formulaic method propounded by john bollinger in the 1980s. Bollinger bands capture around 90 percent of the price action of a coin. John bollinger first introduced the concept behind the how can bollinger bands be integrated into a strategy? Bollinger bands were invented by john bollinger and a re a staple technical analysts tool when charting the markets. The middle line of the indicator is the. A bollinger band® is a momentum indicator used in technical analysis that depicts two standard bollinger bands® were developed and copyrighted by famous technical trader john bollinger. The bollinger bands indicator is an oscillator with respect to trade cryptos or while talking about analysis. Investors also use bollinger bands to help determine buy and sell signals on a stock. A common strategy adopted by traders is to go. Bollinger bands (/ˈbɒlɪnjdʒər bændz/) are a type of statistical chart characterizing the prices and volatility over time of a financial instrument or commodity, using a formulaic method propounded by john bollinger in the 1980s. Bollinger bands provide an upper bound and lower bound based on a simple. Bollinger bands capture around 90 percent of the price action of a coin. The bollinger bands service provides charts, screening and analysis based on bollinger bands. John bollinger first introduced the concept behind the how can bollinger bands be integrated into a strategy? Bollinger bands are named after john bollinger, an american asset manager, and technical analyst. Investors also use bollinger bands to help determine buy and sell signals on a stock. Essentially bollinger bands® are a way to measure and visualize volatility. The middle line of the indicator is the. How to use bollinger bands in trading? Bollinger bands provide an upper bound and lower bound based on a simple. Bollinger bands, a technical indicator developed by john bollinger, are used to measure a market's volatility the bollinger bands (bb) is a chart overlay indicator meaning it's displayed over the price. A bollinger band® is a momentum indicator used in technical analysis that depicts two standard bollinger bands® were developed and copyrighted by famous technical trader john bollinger. Bollinger bands capture around 90 percent of the price action of a coin. Bollinger bands are a type of price envelope developed by john bollinger. In the notoriously fickle cryptocurrency market, bollinger bands are seeing widespread use in predicting possible breakouts. Bollinger bands are technical indicators developed by john bollinger and widely used by stock traders today.

Bollinger Bands Cryptocurrency: Bollinger bands are technical indicators developed by john bollinger and widely used by stock traders today.

Source: Bollinger Bands Cryptocurrency

0 comments:

Post a Comment